Stay Ahead of the Game: Watch Out for Signs of an S&P 500 Downturn

As the stock market continues to fluctuate, investors are constantly on the lookout for warning signs that could indicate a potential downturn in the S&P 500. Understanding these indicators and acting upon them in a timely manner can help investors protect their assets and make informed decisions. Here are some key warning signs to watch out for:

1. Economic Data: Keep a close eye on important economic indicators such as GDP growth, unemployment rates, inflation, and consumer spending. Significant changes in these metrics can signal economic slowdowns and impact the stock market.

2. Interest Rates: The Federal Reserve plays a crucial role in setting interest rates, which have a direct impact on stock prices. Rising interest rates can affect borrowing costs for businesses and consumers, leading to lower spending and potentially lower stock prices.

3. Corporate Earnings: Earnings reports from major companies in the S&P 500 can provide valuable insights into the overall health of the stock market. Declining earnings or lowered profit expectations from these companies could indicate a bearish trend.

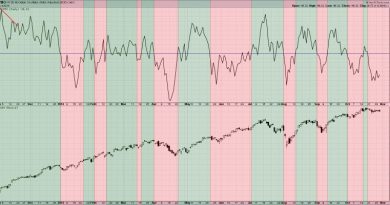

4. Market Volatility: Monitoring market volatility through indicators such as the VIX can help investors gauge the level of uncertainty and fear in the market. Sharp spikes in volatility often precede market downturns.

5. Technical Analysis: Utilizing technical analysis tools such as moving averages, support and resistance levels, and chart patterns can help identify trends and potential turning points in the market. Pay attention to any signs of weakness in the S&P 500 index.

6. Geopolitical Events: Global events such as trade disputes, political tensions, and natural disasters can have significant impacts on the stock market. Stay informed about geopolitical developments and their potential effects on the S&P 500.

7. Investor Sentiment: Sentiment indicators like the put/call ratio, investor surveys, and social media discussions can provide insights into market psychology. Extreme levels of bullishness or bearishness among investors may signal a market reversal.

8. Market Breadth: Analyzing market breadth indicators, such as the number of advancing versus declining stocks, can reveal the underlying strength or weakness of the market. Divergences between market breadth and the S&P 500 index could indicate a reversal.

By staying vigilant and monitoring these warning signs, investors can better prepare themselves for potential downturns in the S&P 500 and take appropriate actions to protect their portfolios. Remember to diversify investments, set clear risk management strategies, and consult with financial advisors to make well-informed decisions in the ever-changing stock market landscape.