Unveiling the SCTR Report: How Coinbase’s Price Surge Impacts Your Portfolio

Cryptocurrency investors have been closely watching the price movements of major digital assets like Bitcoin, Ethereum, and now Coinbase. The recent dramatic price surge of Coinbase has sparked discussions and speculation about the future of the exchange and its impact on the broader crypto market. In this article, we will explore what Coinbase’s price surge means for your investment portfolio and the cryptocurrency market as a whole.

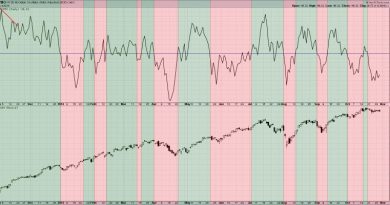

Coinbase, a leading cryptocurrency exchange platform, made history with its direct listing on the Nasdaq on April 14, 2021. The company’s listing was highly anticipated by investors and marked a significant milestone for the crypto industry. Since its debut on the stock market, Coinbase’s stock price has experienced some turbulent movements, with sharp price fluctuations and rapid price surges.

The surge in Coinbase’s stock price reflects the growing mainstream acceptance and adoption of cryptocurrencies. As one of the largest crypto exchanges in the world, Coinbase plays a crucial role in facilitating the buying, selling, and trading of digital assets for millions of users globally. The company’s success is closely tied to the overall health and growth of the crypto market.

For investors, Coinbase’s price surge can be seen as a positive signal for the overall crypto ecosystem. The soaring valuation of the exchange indicates increasing investor confidence in the long-term potential of cryptocurrencies. As more traditional investors and institutions enter the crypto space, the demand for reputable exchanges like Coinbase is expected to soar, further driving up the company’s valuation.

However, it’s essential for investors to exercise caution and not let short-term price movements cloud their judgment. The crypto market is notoriously volatile, and prices can fluctuate wildly within a short period. It’s crucial to conduct thorough research, diversify your investment portfolio, and adopt a long-term investment strategy to navigate the uncertainties of the crypto market successfully.

Moreover, the surge in Coinbase’s price may have broader implications for the cryptocurrency market as a whole. A rising tide lifts all boats, and an increase in Coinbase’s valuation could potentially boost the prices of other digital assets. As more users flock to Coinbase to trade cryptocurrencies, it could lead to increased liquidity and trading volume across the market.

In conclusion, Coinbase’s dramatic price surge is a significant development that underscores the growing mainstream acceptance and adoption of cryptocurrencies. While the surge in Coinbase’s stock price bodes well for the crypto market’s future, investors should remain cautious and approach their investment decisions with a long-term perspective. By staying informed, diversifying their portfolios, and exercising patience, investors can navigate the volatile crypto market successfully and capitalize on the opportunities presented by Coinbase’s price surge.