Bearish Buzz: Markets Gear Up for Heavy News Week

In examining current market trends and forecasting potential outcomes, it is crucial to pay close attention to the indicators signaling short-term bearish sentiment. As the financial landscape braces itself for a week filled with significant news events, investors must be prepared to navigate the volatility ahead.

One of the key indicators pointing towards a bearish outlook is the recent market data reflecting a decline in trading volume. When trading volume decreases, it often indicates a lack of confidence among market participants. This decline suggests that investors may be hesitant to make significant moves, leading to a stagnation in market activity. As such, it is important to monitor trading volume closely in the coming days to gauge market sentiment accurately.

Another factor contributing to the bearish signal is the current geopolitical landscape. With tensions rising in various regions and uncertainties surrounding key global issues, such as trade relations and political instability, investors are faced with heightened risk factors that could impact market performance. The potential for unexpected developments or negative news events could further exacerbate market volatility and contribute to a downturn in asset prices.

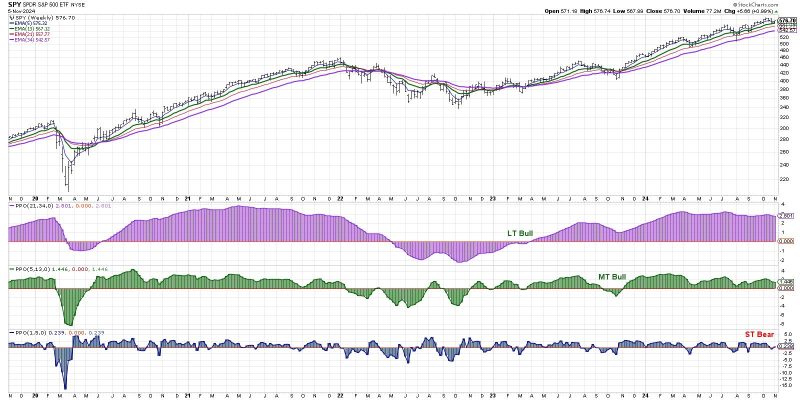

Additionally, technical analysis tools, such as moving averages and trend lines, are indicating a downward trajectory in certain market sectors. These indicators provide valuable insights into the momentum of market movements and can help investors anticipate potential trend reversals. By paying attention to these technical signals, investors can position themselves strategically to mitigate potential losses and capitalize on emerging opportunities.

Furthermore, the upcoming news-heavy week is expected to bring a slew of economic data releases, corporate earnings reports, and central bank announcements. These events have the potential to significantly impact market sentiment and drive price action in various asset classes. Investors should stay informed about these developments and be prepared to react swiftly to changing market conditions.

In conclusion, the confluence of factors signaling a short-term bearish outlook demands increased vigilance from investors. By closely monitoring trading volume, geopolitical risks, technical indicators, and upcoming news events, market participants can navigate the volatile landscape and make informed decisions to protect their investments. As the markets brace for a news-heavy week, it is crucial for investors to remain agile and adaptable in their strategies to weather potential storms and seize opportunities that may arise.